what is a provisional tax

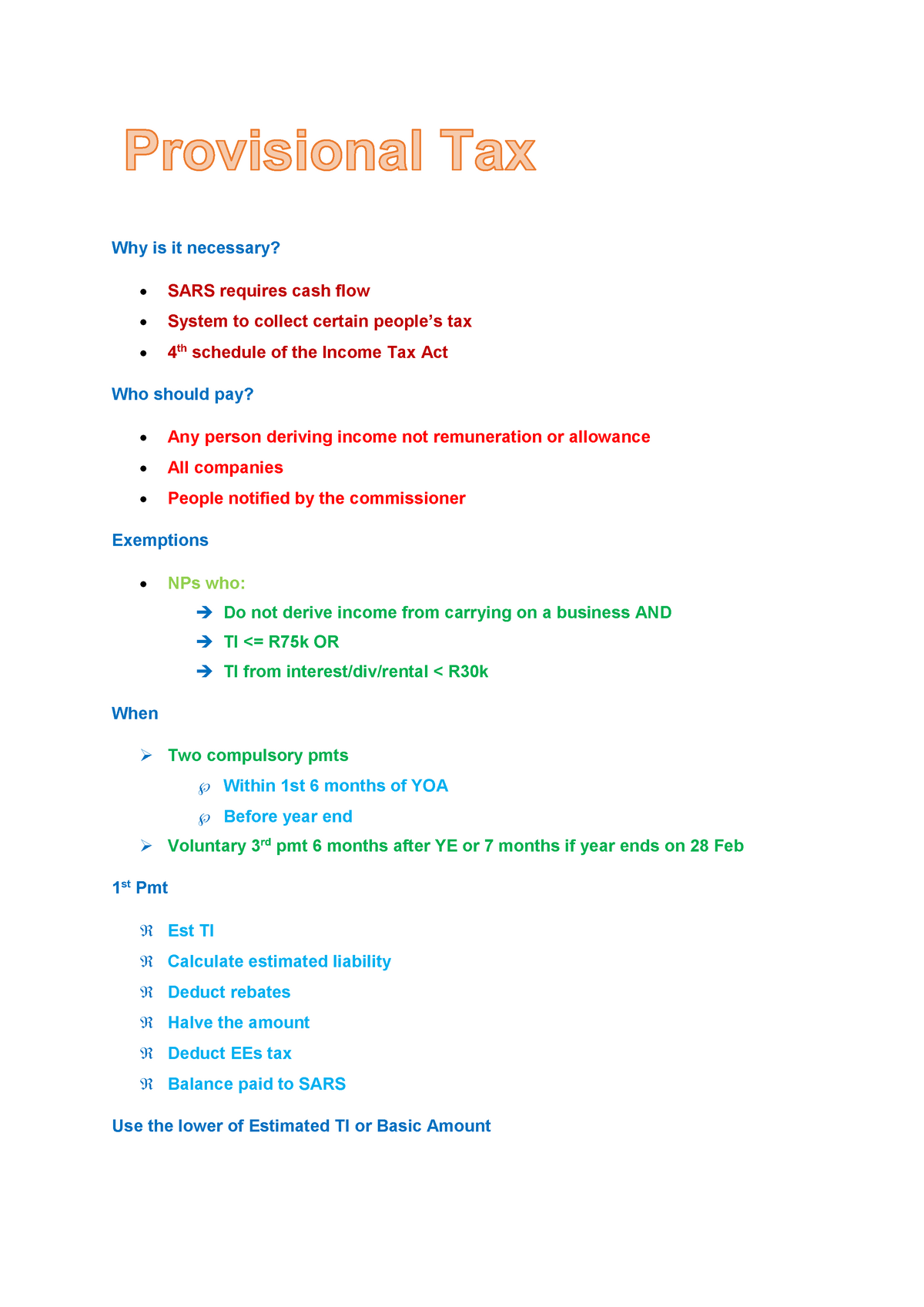

Provisional tax is tax you pay in advance. Provisional tax is an income-based calculation of the estimated tax payable on non-employment income.

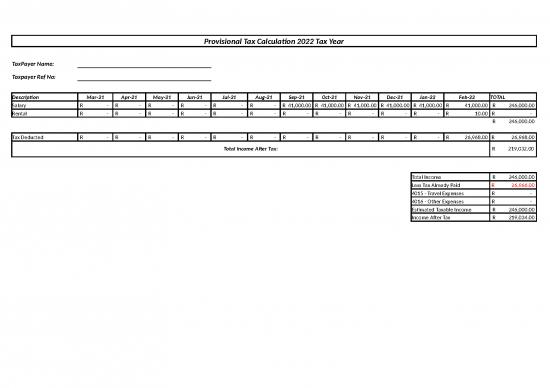

2022 Taxassist Provisional Tax Income Calculation

Provisional tax is not a separate tax from income tax.

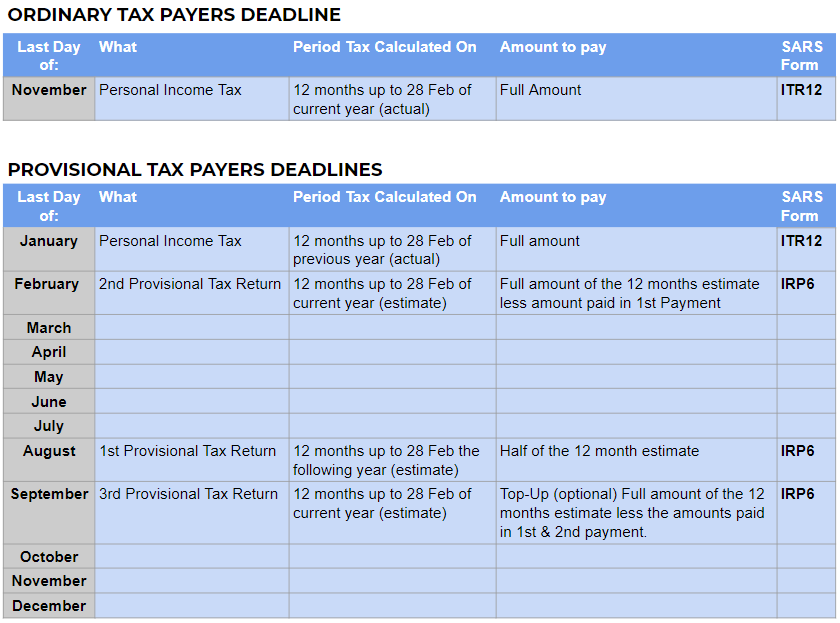

. A provisional taxpayer is required to pay instalments of income tax called provisional tax during the income year rather than at the end of the year when a tax return is filed. Provisional tax is income tax you pay in instalments during the year. Everyone pays income tax if they earn income.

This assists taxpayers in. It is a method of paying the income tax liability in advance to ensure that the taxpayer does not have a large tax debt on. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the relevant year of.

Provisional tax helps you manage your income tax. To qualify for provisional tax as of the financial year 2021 onwards. A business making a commission payment or payment under a formal contract for services is required to withhold 5 withholding tax also known a provisional tax.

Youll have to pay provisional tax if you had to. Your provisional income is a. It is mandatory while PAYE is not mandatory if you receive taxable.

Provisional tax is not a. Provisional tax is not a separate tax from income tax. Not EVERYONE pays provisional tax.

Provisional Tax is not separate tax it is only the method of paying tax that is due. Self Employed people rental property owners and people. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the.

The purpose of the payments is to help you the taxpayer avoid getting too far behind on your taxes. According to the information of the Inland Revenue Department Provisional Tax is a government requirement which is calculated based on the taxpayers income in the previous. It is a method of paying the income tax liability in advance to ensure that the taxpayer does not remain with a large tax.

If you earn non-salary income for example rental income. Provisional tax is paid by people who earn income other than a salary traditional remuneration paid by an employer. Provisional tax is the IRDs tool to prevent these sorts of tax bills.

Provisional tax is not a separate tax. Provisional tax is not a special separate type of tax but simply a mechanism to pay your taxes during the tax year instead of having a large amount due to SARS on assessment. Provisional tax is not a separate tax.

The main reason is to ensure the Taxpayer is not paying large amounts on assessment so is the tax. You pay it in instalments during the year instead of a lump sum at the end of the year. Provisional tax can be explained as an advance payment made to offset against the Income Tax Liability for the respective year of assessment.

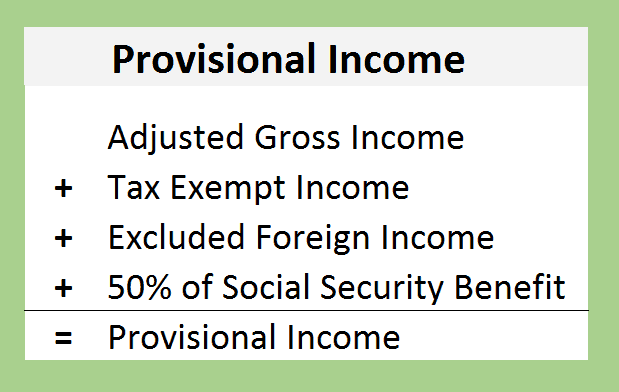

Provisional income is a tool used by the IRS to determine whether youll pay federal income tax on part of your Social Security benefits.

Provisional Tax Demystified Thrive Cfo

Provisional Tax 2021 Dinos Antoniou Co Ltd Certified Public Accountants

Provisional Tax Why Is It Necessary Sars Requires Cash Flow System To Collect Certain Tax 4th Studocu

Sa Revenue Service On Twitter An Example Of Provisional Tax Estimates Based On The Applicable Provisional Tax Payment Periods Yourtaxmatter Https T Co Uuz09vltoa Twitter

Provisional Tax Return 2021 Totalpro

Dispute Resolution Process And Provisional Tax Ppt Download

Holdover Of Provisional Tax Ricky Cheung

Taxes On Social Security Social Security Intelligence

Paye And Provisional Tax Payments 2007 2008 2016 2017 Download Scientific Diagram

![]()

Stream Episode Provisional Tax Use Of Money Interest Time For A Residential Land Value Tax More By The Week In Tax Podcast Listen Online For Free On Soundcloud

The Basics Of Provisional Tax Estimates Provisional Tax Penalties And Interest Fhbc

Provisional Tax 202301 Virtual Tax Accounitng

How Aim Compares To The Other Provisional Tax Options

Provisional Tax Return 2022 English Stalworthpro